• Login to GST Portal, select services, refund, applications for refund, export with payment of tax, RFD-01.

• File the RFD-01 refund application in delhi. With all the details and precautions as it is not a rectification form.

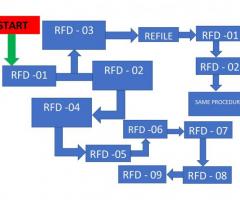

• After submission of the form, the application is passed to the processing officer. The processing officer will issue an acknowledgement via RFD-02/03. Followed by provisional and final sanction order RFD-04/06.

• The processing of the application by an officer and the issue of payment order RFD-05 will be done after PFMS validates the bank account mentioned in the forms.

• After complete validation of the payment order, processing within PFMS will take place which also includ...

• Login to GST Portal, select services, refund, applications for refund, export with payment of tax, RFD-01.

• File the RFD-01 refund application in delhi. With all the details and precautions as it is not a rectification form.

• After submission of the form, the application is passed to the processing officer. The processing officer will issue an acknowledgement via RFD-02/03. Followed by provisional and final sanction order RFD-04/06.

• The processing of the application by an officer and the issue of payment order RFD-05 will be done after PFMS validates the bank account mentioned in the forms.

• After complete validation of the payment order, processing within PFMS will take place which also includes DDO/PAO approval.

• After the payment order, RFD-07B or RFD-08 will be issued. In response to RFD-08, RFD-09 will be issued.

RFD-01

RFD-01 is an application form used for the refund of GST under various cases and categories. It can be filed on the GST portal for a claim.

RFD-02

RFD-02 is an acknowledgment that is made available to the applicants through the common portal indicating the date of the claim for the GST refund.

RFD-03

RFD-03 is a deficiency memo that is issued to applicants who are required to file a fresh/new refund application for which a new ARN will be issued.

RFD-04

RFD-04 is a provisional refund where the amount of refund claimed by the applicant, and the balance amount left that will be refunded later( which is 10% of the refund claimed). The amount allowed on a provisional basis will be provided under each category of different taxes- IGST, CGST, SGST/UTGST.

RFD-05

The payment order where the amount of refund and interest will be issued by the officer. The refund will be processed on this electronically by PFMS.

RFD-06

RFD-06 is a provisional or final GST refund sanction order that is issued by the officer. It will be issued by a GST officer within 60 days of application submission for a GST refund.

RFD-07B

RFD7B is issued for complete adjustment or withholding of refund.

RFD-08

RFD-08 is a form also called “Show case notice” issued by a GST officer on the rejection of a refund application in delhi. This form contains why the application is rejected.

RFD-09

RFD-09 also called “ Reply to show cause notice” is a reply in accordance with RFD-08 by the applicant. More info visit to lexntax.com